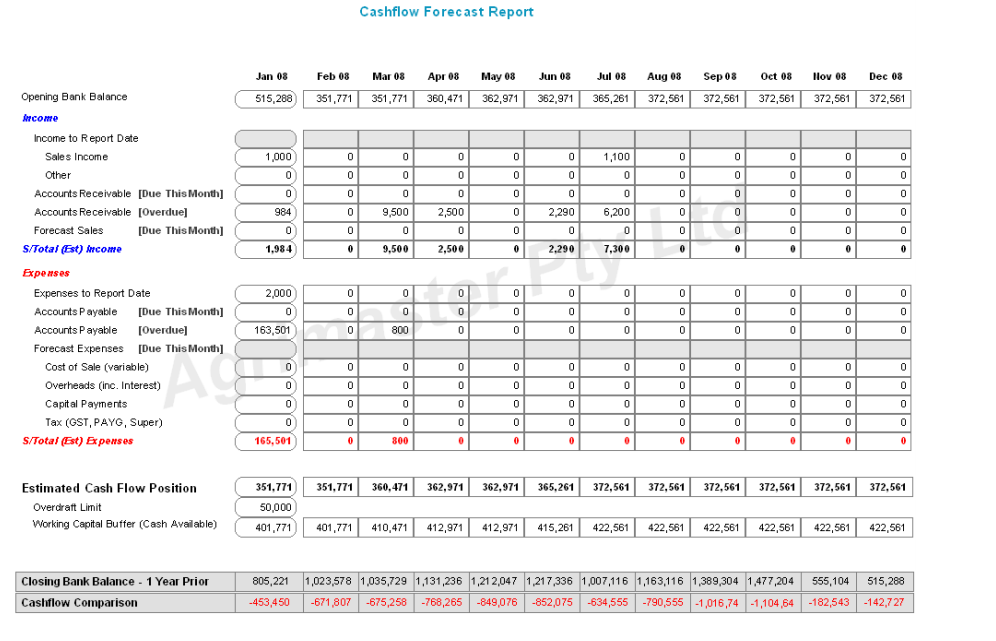

This is normally taken from the most up to date and accurate reflection of current positions, which is often a bank account or ERP position. It might sound obvious but the starting point for a cash flow forecast is the opening balance. Here we take a look at the nuts and bolts of how a cash flow forecast is constructed. For example a company seeking to gain visibility over quarter end covenant positions will need a different forecasting process from a company who wants to more closely manage debt repayments on a weekly basis. This may seem like a simple step but defining exactly what the cash forecasts will be used for allows a company to design a process that exactly meets their needs. A question we are often asked is how do you build or create cash flow forecast models? As a precursor to creating a cash flow forecast the starting point is to decide what the cash forecast will be used for.

#CPE CASHFLOW FORECASTING HOW TO#

In this blog post we take a look at how to go about creating a cash flow forecast for the purposes of direct cash forecasting. From this program, you'll be ready to handle unexpected expenses, jump at new opportunities with confidence and always stay one step ahead of the competition.There are number of different ways to create cash flow forecast models. Effective cash flow modeling puts you in charge of your cash flow, allowing you to make essential purchases, cover operating costs and plan for future growth. Most importantly, you'll learn how to identify areas of opportunity for trimming expenses.ĭon’t leave your organization suspect to insufficient funds or missed opportunities due to poor cash flow management. You'll discover the impact slow receivables have on your bottom line and how obsolete or slow-moving inventory leads to higher inventory costs. From this workshop, you'll be able to recognize vendor terms that don't favor your organization so you can negotiate a better contract. Facing increased risks or missed opportunities associated with projecting cash flow too high… orĪn effective cash flow training course can help you avoid these common pitfalls and put you in complete control of your resources.Unable to pay bills or payroll even though sales and profit are up?.Unaware of the cost associated with slow-paying and no-paying customers?.Falling victim to inadequate planning for purchases, upgrades or replacement of big-ticket items?.Constantly running short of cash due to out of control expenses?.Having a good system in place to manage cash flow during good times contributes to an organization's success, allowing it to take advantage of opportunities for growth and providing a competitive edge.ĭoes your organization have an effective cash flow forecasting strategy in place, or do you find yourself… Many organizations only begin to focus on cash flow management during bad times. Inadequate cash flow forecasting management is one of the leading causes of business failure.

Are you confident in your current forecasting strategy? This course can help you! Whether your organization is in growth mode, status quo, losing ground or survival mode-cash flow forecasting is critical to your success. Knowing when money is coming in or going out and how much is being exchanged is often the deciding factor when it comes to making key business decisions. Cash flow forecasting is one of the most critical aspects of running a business of any

0 kommentar(er)

0 kommentar(er)